Calculate correctly

With VATRules, you access a database of certified VAT rates on-demand – directly in your system environment! Your product prices thus automatically consider the VAT rates currently applicable in the EU-27, Great Britain, Northern Ireland and Switzerland.

All standard rates, reductions, and temporary adjustments

eClear’s VATRules database includes not only the standard VAT rates, but also all country-specific reductions, exemptions and temporary adjustments.

VATRules is the basis for the preparation of correct VAT returns. Because by automated updates, your product prices always consider the tax rate required depending on the country of delivery.

Reduce risk, secure margin

Many merchants set the same product price when selling to other EU countries to simplify their processes. However, in addition to the liability risks, they often underestimate the margin losses that can occur if local VAT regulations are not considered or their sources are outdated.

Your advantages with VATRules

Article-specific allocation of applicable VAT rates

- More than 1.2 million eClear IDs enable the precise combination of product and country-specific applicable tax rate

Always up to date

- The on-demand database is continuously updated

Certified data quality

- Consideration of the applicable EU and national legislation, with currently more than 300,000 exemptions.

Reliable provision in your shop

- Powerful REST API with certified response time under 100 ms

Financial Dashboard SPOT is included!

- VATRules includes the use of SPOT free of charge for the duration of the contract.

Strengthening your VAT compliance

- Compliant application of the VAT rates applicable to the EU-27, Great Britain, Northern Ireland and Switzerland within your existing business processes; basis for the preparation of correct VAT declarations

Competitive and margin advantages

- By considering the country-specific applicable regulations, you never charge too little or too much VAT

Time and costs savings

- Process optimisation through automation (e.g. fast go to market to expand your business to other countries; avoidance of corrections)

Increasing customer satisfaction

- Correct application of the locally applicable VAT rates when designing your product prices

APIs and plugins

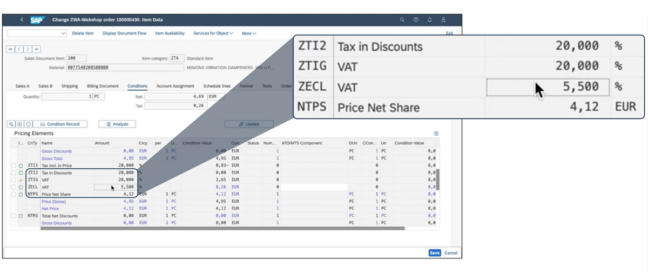

VATRules is available as a plugin for various systems (for example SAP S/4Hana, SAP Commerce) or can also be integrated into your system environment via API.

Illustration: In SAP S/4Hana, the provision of VAT rates is directly integrated in SAP tax determination (tax key determination).

Focus on your business

With VATRules, we offer a customised solution to overcome your VAT compliance challenges without setting up an internal tax department. Our API lets you focus on your core business and simultaneously fulfil legal requirements.

Lea-Luisa Weichselbaum, Teamlead VATRules